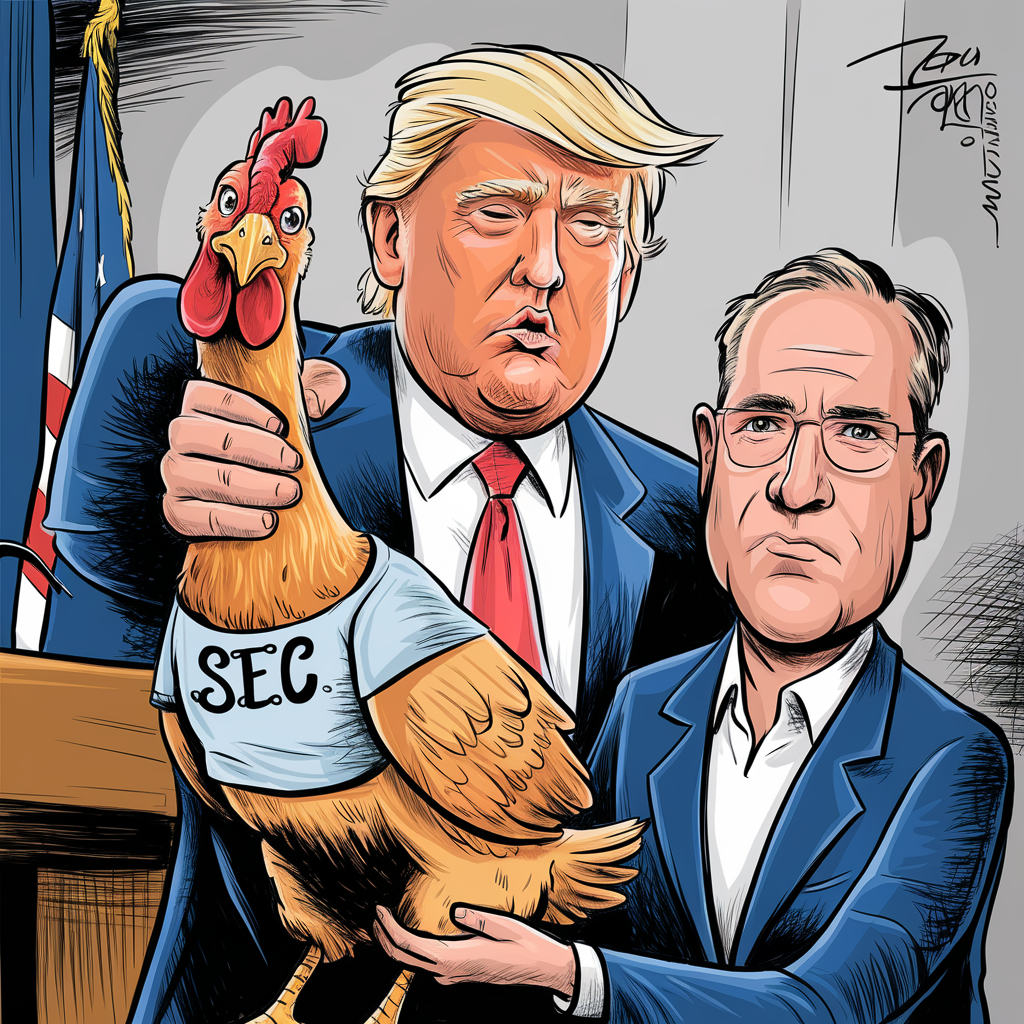

The U.S. Securities and Exchange Commission (SEC) has once again postponed its decision on whether to approve options trading for spot Ethereum exchange-traded funds (ETFs). In a filing issued Friday, the SEC announced that it would delay ruling on a proposal from NYSE American LLC to list options on spot Ethereum ETFs. The agency cited the need for further analysis and public commentary, underscoring its ongoing concerns about market manipulation, investor protection, and fair trading practices.

SEC Extends Deliberation Period for Spot Ethereum ETF Options

The decision marks the second delay by the SEC, which was initially expected to make a determination by Monday, November 11. The agency’s filing pointed to the requirements of the Securities Exchange Act, specifically Section 6(b)(5), which mandates that any proposed rule change must prevent fraudulent practices, protect investors, and uphold a fair and efficient market.

“The Commission seeks to allow additional time for thorough evaluation and public input,” the filing stated. “The proposal must ensure market integrity and align with investor protection mandates.”

What’s at Stake: NYSE, Grayscale, and Bitwise Applications

The SEC is considering several proposals related to spot Ethereum ETFs. NYSE American LLC, in collaboration with Grayscale and Bitwise, filed for a rule change on August 7 to list and trade options on multiple Ethereum-based products. These include the Bitwise Ethereum ETF, the Grayscale Ethereum Trust, and the Grayscale Ethereum Mini Trust. Additionally, the proposal covers “any trust that holds ether,” broadening the scope of potential listings.

BlackRock’s iShares Ethereum Trust (ETHA), which is also under review, adds another layer of complexity to the SEC’s considerations. The SEC had previously set November 10 as the decision deadline for the Bitwise and BlackRock spot Ethereum ETFs but has now extended that timeline. The regulatory body will use this additional period to scrutinize whether the applicants have provided sufficient evidence that their offerings meet the standards set by U.S. securities laws.

Regulatory Concerns and Investor Protection

The SEC’s hesitation revolves around fundamental regulatory concerns, particularly the risk of market manipulation and the adequacy of measures to safeguard investors. The Commission’s scrutiny comes as the crypto sector continues to grapple with volatility and regulatory ambiguity. By opening proceedings, the SEC aims to evaluate the robustness of the proposed rule changes and whether these financial products could destabilize markets or expose retail investors to undue risks.

“The agency’s ongoing deliberation signals a cautious approach to incorporating more complex crypto products into regulated markets,” noted financial analyst James Bartlett. “While investor demand for Ethereum-based financial instruments is growing, the SEC appears determined to proceed carefully to avoid setting a precedent that could have unintended consequences.”

Market Impact and Investor Sentiment

Despite regulatory delays, interest in Ethereum ETFs remains robust. On Thursday, Ethereum-based funds recorded $79.74 million in net inflows, alongside $466.39 million in trading volume. This trading volume far exceeded the typical daily range of $100 million to $200 million, signaling strong institutional and retail demand for Ethereum investment products.

The heightened activity comes as Ethereum (ETH) saw a price increase of 3.41%, reflecting optimism in the broader crypto market. However, investors are growing increasingly eager for regulatory clarity. The approval of spot Ethereum ETFs and related options would mark a significant milestone, potentially attracting more institutional capital and offering new hedging and trading strategies.

Industry Reactions and Looking Ahead

The crypto community remains divided over the SEC’s approach. Some market participants argue that the agency’s caution is justified, given the high stakes involved in bringing spot crypto ETFs and derivatives into traditional financial markets. Others believe the delays stifle innovation and limit investment opportunities for U.S. investors compared to other jurisdictions that have already embraced crypto ETFs.

For asset managers like Grayscale, Bitwise, and BlackRock, the SEC’s prolonged decision-making process adds another layer of complexity to an already intricate regulatory landscape. Each firm is awaiting a favorable ruling to expand their product offerings, which could have a transformative effect on the digital assets market.

Meanwhile, investors and industry leaders will continue to monitor the SEC’s next steps, as the outcome of this deliberation could set the tone for future crypto-related regulatory decisions. If approved, spot Ethereum ETFs with options trading could open new avenues for investment, further legitimizing Ethereum as an asset class and enhancing its integration into the global financial ecosystem.

The SEC’s next moves will be crucial, not just for Ethereum but for the broader cryptocurrency market. As the agency navigates this complex regulatory landscape, stakeholders are eager for a resolution that balances innovation with investor protection.