Ethereum has recently been in the spotlight as interest in ETH exchange-traded funds (ETFs) continues to rise. Analysts are closely monitoring this trend, as the accumulation of these ETFs could significantly influence the price of Ethereum in the near future. With October approaching, many investors are speculating whether this growing interest will lead to a substantial increase in ETH’s price.

The enthusiasm surrounding ETH ETFs stems from their potential to attract institutional investors, providing a more accessible way for the public to invest in Ethereum. This shift could bring in significant capital, potentially driving the price upward as demand increases. Historical patterns suggest that such developments often lead to bullish market trends, prompting many to wonder if we are on the brink of a price surge this October.

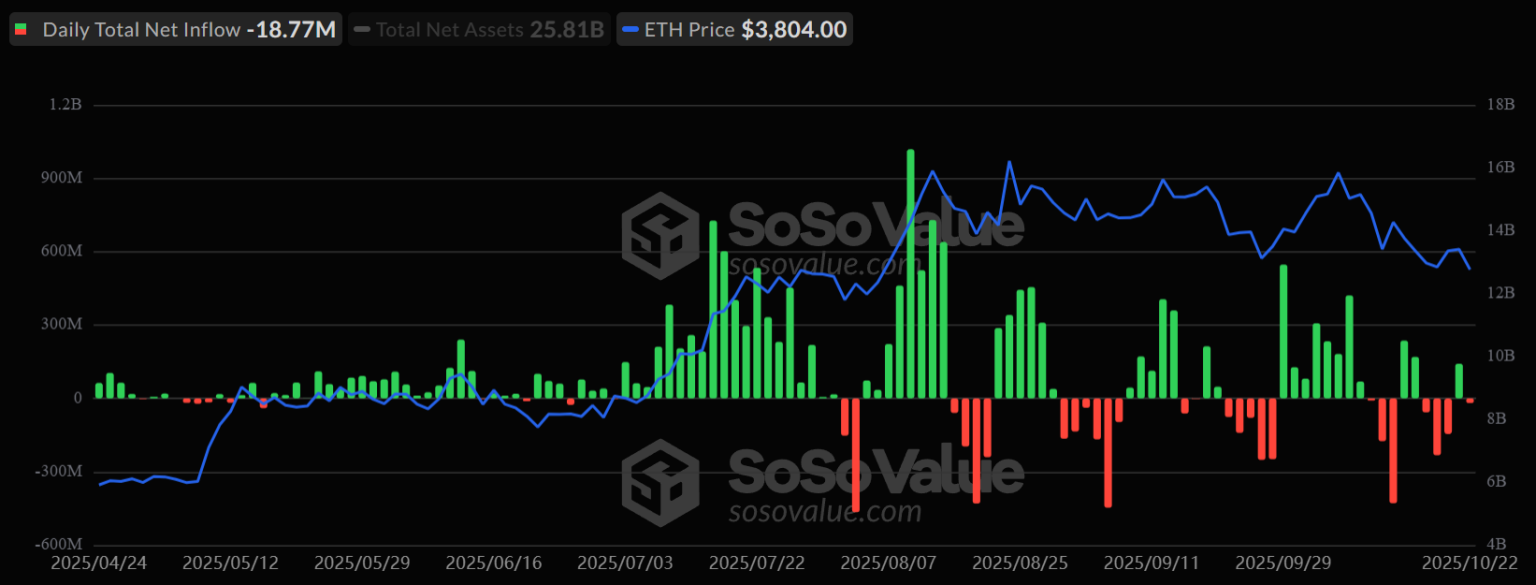

ETF net flows alongside spot price. Source: SoSo Value.

Market sentiment plays a crucial role in cryptocurrency valuations, and as more investors turn their attention to Ethereum, the dynamics of supply and demand may shift dramatically. Observers are keen to see how the market reacts in the coming weeks, particularly as regulatory clarity around ETFs continues to evolve.

As the situation unfolds, Ethereum enthusiasts and investors alike are keeping a close watch on market indicators and news that could signal a major price movement. The question on everyone’s mind is whether the current momentum will translate into a significant price increase for ETH this month.

As October progresses, various factors could contribute to the potential price movement of Ethereum. One significant element is the ongoing developments within the broader cryptocurrency market and how they may impact investor sentiment. Recent trends indicate a growing acceptance of cryptocurrencies among traditional financial institutions, which could bolster confidence in Ethereum and its long-term prospects.

Moreover, the Ethereum network itself is undergoing various upgrades aimed at enhancing scalability and efficiency. The transition to Ethereum 2.0, which focuses on a proof-of-stake consensus mechanism, is expected to improve transaction speeds and reduce energy consumption. These enhancements could make Ethereum more appealing to both retail and institutional investors, further fueling demand.

Additionally, macroeconomic factors, such as interest rates and inflation, could play a role in shaping investor behavior. As central banks around the world adjust their monetary policies, many investors are seeking alternative assets like cryptocurrencies to hedge against economic uncertainty. This growing interest in digital assets could lead to increased investment in Ethereum, particularly if traditional markets exhibit volatility.

Technical analysis is another critical aspect that traders are considering. Many analysts are examining key price levels and indicators to determine potential entry and exit points for Ethereum. If the price breaks through certain resistance levels, it could trigger a wave of buying activity, propelling the price higher. Conversely, any significant downturn could lead to profit-taking and increased volatility.

ETH / USD 1-day chart, bull flag pattern. Source: TradingView.

As the month unfolds, the confluence of these factors—growing ETF accumulation, network upgrades, macroeconomic influences, and technical analysis—creates an intriguing environment for Ethereum. Investors are eager to see whether these elements will culminate in a price surge or if caution will prevail in the face of market uncertainties.

In conclusion, while the potential for an October price increase for Ethereum appears promising, it remains essential for investors to stay informed and prepared for any market fluctuations. The landscape is ever-changing, and those who keep a watchful eye on developments may find themselves well-positioned to capitalize on the opportunities that arise.

Source: Cryptonews Edited by Sonarx