The cryptocurrency market has experienced a sharp and sudden downturn, wiping out a significant amount of value across major digital assets in just a short window. Bitcoin, Ethereum, Solana, and many altcoins saw deep declines, triggering concern among investors and companies that hold large crypto reserves.

Massive Market Drop

Within a single day, the global crypto market lost tens of billions of dollars in value. Bitcoin fell by close to double-digit percentages, dragging the rest of the market down with it. Ethereum and Solana also recorded steep pullbacks, leaving both retail and institutional investors uneasy about short-term price stability.

Source: Cryptonews

One Treasury Firm Still in Profit Despite the Crash

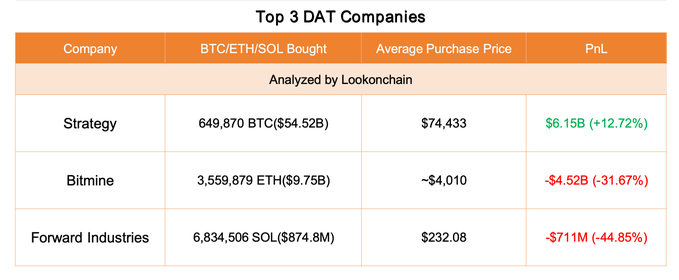

Among companies that hold crypto as part of their corporate balance sheet, the performance gap is widening dramatically. One firm, now renamed simply Strategy (formerly MicroStrategy), remains comfortably in profit. The company owns an extremely large Bitcoin treasury—hundreds of thousands of BTC—acquired over several years. Even after the market drop, their reserves still sit on multi-billion-dollar unrealized gains because their average purchase price is below current market levels.

Ethereum-Focused Treasuries Facing Heavy Losses

Not every treasury strategy has played out well. Firms that chose to load up on Ethereum at higher prices are now facing sizeable paper losses. Some companies acquired millions of ETH at price levels far above the current market, putting them deep in the red. This includes firms whose ETH holdings now show double-digit percentage declines in unrealized value. The downturn is pressuring their financial positions and raising concerns among shareholders.

Solana Treasuries Under Pressure

Companies that built large positions in Solana are also taking substantial hits. Some treasuries accumulated their SOL tokens during peak market enthusiasm at prices well over $200, which has now resulted in significant drawdowns. A few firms remain profitable due to long-term holding strategies or lower entry prices, but they are exceptions rather than the norm.

Different Corporate Reactions to the Downtrend

As the downturn sharpens, some companies have already announced stock buyback programs in an attempt to stabilize investor confidence. A handful of others are reportedly preparing to sell part of their crypto reserves to manage liquidity, reduce exposure, or meet operational needs. For some treasury-heavy companies, this phase is proving to be an important resilience test.

Wider Implications for Crypto Treasury Management

Analysts note that the current conditions could expose structural weaknesses in firms that rely heavily on digital assets for corporate value. Companies with poor timing, limited liquidity, or highly concentrated holdings may be forced into defensive actions such as asset sales. Meanwhile, the risk-off sentiment in global financial markets is pushing more investors toward safer assets, creating additional downward pressure on cryptocurrencies.

Overall, the volatility in the market is highlighting the stark differences between companies that adopted long-term, steady accumulation strategies and those that entered at market peaks. While some treasury portfolios remain highly profitable, others are facing a challenging road ahead as they navigate losses and tighter financial conditions.

Source: Lookonchain

Source: Cryptonews Edited by Sonarx