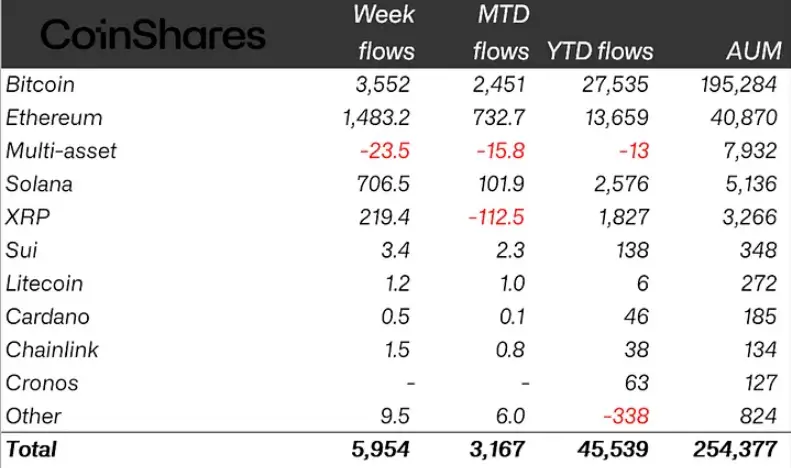

Global cryptocurrency investment products witnessed one of their strongest weeks on record, drawing in approximately $5.95 billion in new capital. This surge in inflows came even as concerns about a potential U.S. government shutdown weighed on the broader financial markets.

The bulk of the inflows came from Bitcoin investment vehicles, which captured around $3.6 billion, highlighting a renewed wave of institutional and retail investor interest in the leading digital asset. Analysts suggest that the sustained demand for Bitcoin reflects growing confidence in its long-term role as both a hedge against economic uncertainty and a core investment asset.

Other cryptocurrencies also benefited from the bullish sentiment. Ethereum-based funds recorded over $1.2 billion in inflows, signaling that investors are regaining trust in the network’s ecosystem after months of muted activity. Additionally, alternative assets such as Solana and XRP attracted noticeable capital, demonstrating that interest is broadening beyond the top two cryptocurrencies.

The total assets under management (AUM) across digital asset funds surged beyond $250 billion, marking a significant milestone for the industry. This reflects not just price appreciation but also sustained net inflows, a sign that institutional investors are gradually integrating crypto into diversified portfolios.

However, the market’s momentum faces potential regulatory headwinds. In the United States, growing fears of a government shutdown have raised questions about whether the Securities and Exchange Commission (SEC) will be able to maintain its timeline for reviewing and approving new spot Bitcoin exchange-traded funds (ETFs). A delay in these approvals could temporarily slow institutional adoption, though most analysts expect demand to remain strong once the regulatory uncertainty clears.

Industry experts say the record-breaking inflows underscore how far the digital asset market has matured. Once dominated by speculative retail traders, the landscape is now increasingly shaped by institutional investors, ETF products, and long-term strategic positioning.

Market observers note that this surge in capital inflows aligns with a broader shift in investor behavior. Unlike previous bull cycles driven mostly by hype and short-term speculation, the current trend suggests that investors are viewing digital assets as part of longer-term portfolio strategies. This shift has been supported by the growing availability of regulated investment products, including exchange-traded funds and institutional-grade custodial services.

Geographically, the majority of the inflows were concentrated in the United States, reflecting strong demand for Bitcoin-linked products. However, European and Canadian crypto funds also saw meaningful participation, highlighting that global interest remains robust despite economic uncertainties. Analysts believe this geographic diversification could play a key role in stabilizing the market, making it less dependent on a single region’s regulatory stance.

Another factor driving the surge is macroeconomic pressure. With inflation concerns lingering and traditional markets facing volatility, many investors are turning to cryptocurrencies as a potential hedge and alternative asset class. The expectation that central banks may ease monetary policies in the coming months has further boosted optimism, encouraging fresh capital to flow into risk assets like Bitcoin and Ethereum.

Despite these positive trends, regulatory uncertainty in the U.S. remains a critical issue. A potential government shutdown could slow down the SEC’s operations, delaying the much-anticipated approvals for spot Bitcoin ETFs. These approvals are considered a major gateway for institutional investors to enter the crypto space in a more regulated and structured manner. Any delays could inject short-term caution into the market, though long-term sentiment remains upbeat.

Market strategists emphasize that the record-breaking $5.95 billion inflow is a clear signal of growing market maturity and investor confidence, even amid political and economic turbulence. If regulatory clarity improves and ETF approvals proceed as expected, many believe that the crypto investment landscape could enter a new phase of sustained growth, potentially setting the stage for broader mainstream adoption.

Looking ahead, analysts believe that the combination of strong capital inflows, growing institutional interest, and the potential approval of spot Bitcoin ETFs could set the stage for a new growth cycle in the digital asset sector. While short-term volatility is inevitable—especially if regulatory decisions are delayed—long-term indicators suggest a strengthening foundation for the crypto market.

Several investment firms have already adjusted their forecasts, anticipating that Bitcoin and other major cryptocurrencies could experience significant upward momentum over the coming months. This optimism is partly driven by expectations that a regulated ETF market will open the door for pension funds, hedge funds, and large asset managers to gain exposure to digital assets in a more secure and compliant manner.

Crypto ETP flows by asset as of Friday (in millions of US dollars). Source: CoinShares

However, experts caution that investor education and regulatory clarity will be crucial to sustaining this momentum. They stress that while the surge in inflows is a positive sign, the industry must continue to address concerns around market transparency, security, and compliance to build lasting trust among both retail and institutional players.

Source: cointelegraph Edited by Sonarx