Ethereum Could Enter Major Revaluation Phase as Liquidity Surges, Says Hedge Fund

A leading crypto hedge fund, XWIN Finance, believes Ethereum may be on the verge of a significant price revaluation, potentially reaching the $10,000 mark, if global liquidity levels continue to rise. The firm’s analysis connects the expansion of the global money supply with Ethereum’s tightening exchange reserves, creating favorable conditions for a sharp upward move in the coming months.

Over the past three years, the global financial landscape has witnessed a massive increase in liquidity, with the U.S. M2 money supply climbing to approximately $22.2 trillion. This influx of capital has historically benefited major assets such as Bitcoin, driving strong price rallies during periods of credit expansion. According to XWIN Finance, Ethereum has so far lagged behind Bitcoin in fully reflecting this wave of liquidity—but that may be changing.

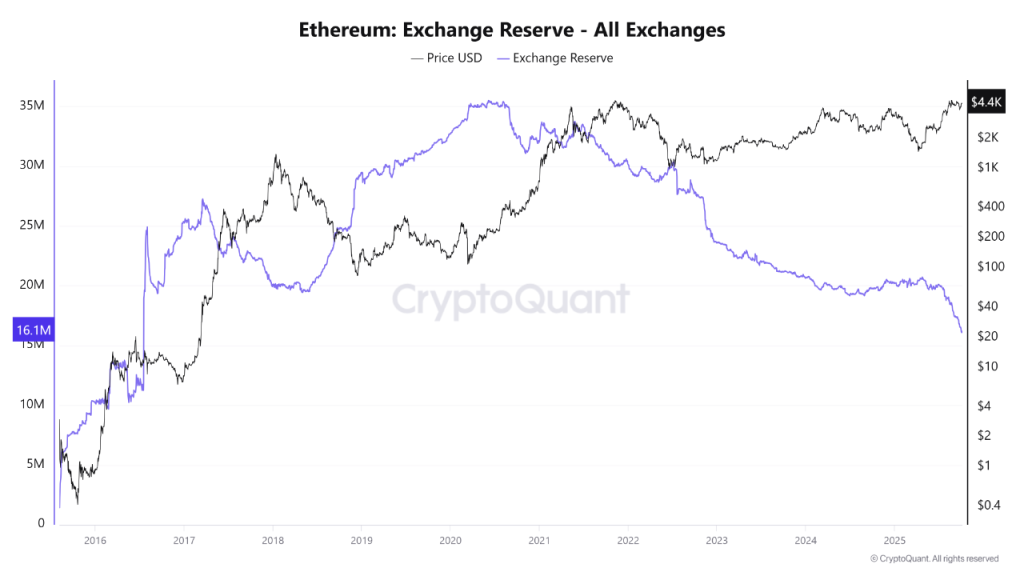

One of the most important factors highlighted by the hedge fund is the decline in Ethereum reserves held on centralized exchanges. Since 2022, exchange balances have fallen by more than 25%, signaling that fewer tokens are readily available for sale. This drop in supply typically reduces selling pressure, paving the way for price acceleration when demand spikes.

Source: CryptoQuant

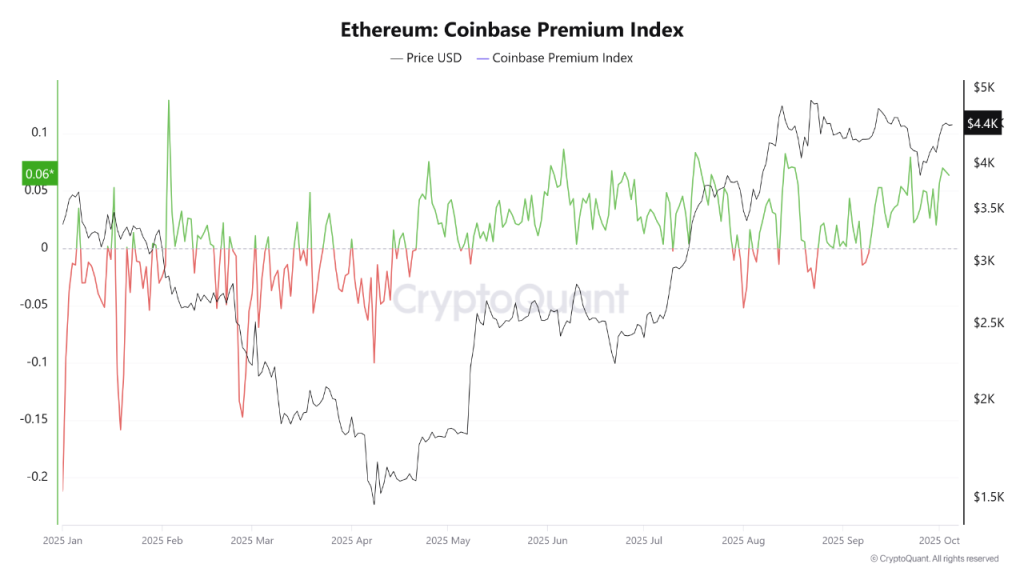

XWIN analysts describe this phenomenon as a “liquidity lag”, meaning Ethereum’s market response has been slower than Bitcoin’s despite similar macroeconomic tailwinds. On-chain data now suggests this gap is beginning to close, with accumulation trends and reduced supply dynamics pointing toward the start of a new valuation phase for ETH.

Their outlook aligns with several prominent voices in the crypto space. Arthur Hayes, co-founder of BitMEX, has publicly projected that Ethereum could climb to $10,000 by the end of 2025. His forecast is based not only on cryptocurrency market factors but also on broader macroeconomic and geopolitical shifts. Hayes argues that the U.S. is moving toward a “wartime economy” model under the Trump administration, characterized by aggressive credit expansion and increased government spending. Such policies, historically, have flooded financial markets with liquidity, driving risk assets higher.

Kevin Rusher, founder of RAAC, shares a similarly bullish stance. He believes that institutional adoption, combined with Ethereum’s attractive staking yields, could generate powerful demand for ETH. As more institutions integrate Ethereum-based products into their portfolios, and as more ETH is locked up for staking, the available liquid supply continues to shrink. This supply-demand dynamic, Rusher suggests, could push prices sustainably above the $5,000 range and set the stage for further rallies.

From a technical analysis standpoint, Ethereum is currently testing a major resistance zone around $4,800. This price level has historically acted as a ceiling for upward moves and represents a key psychological barrier for traders. If Ethereum manages to break and hold above this resistance on the weekly chart, many analysts believe the path will open toward the next price targets between $7,000 and $10,000. These projections are supported by Fibonacci extension models and previous market behavior during similar breakout scenarios.

On the other hand, analysts also caution that a rejection at this level could lead to a healthy pullback. In such a case, Ethereum might revisit the $3,500 to $3,800 support range, which aligns with both long-term trendline support and Fibonacci retracement levels. Such a correction, while potentially steep, could provide a solid base for the next major rally phase.

The current environment combines favorable macroeconomic liquidity, on-chain supply constraints, growing institutional interest, and technical patterns that all point toward the possibility of a major price movement. Whether Ethereum can capitalize on these conditions depends largely on whether the rising liquidity trend continues and whether buyers can push the price past critical resistance levels.

Global Liquidity Expansion: A Key Catalyst for Ethereum

One of the most critical forces driving Ethereum’s potential price surge is the ongoing expansion of global liquidity. Over the last few years, central banks and governments have adopted accommodative monetary policies, injecting vast amounts of money into financial systems to stimulate growth.

The U.S. M2 money supply, a broad measure of circulating cash and easily accessible deposits, has grown sharply to reach roughly $22.2 trillion. Historically, when liquidity floods markets, capital tends to move toward riskier assets in search of higher returns. Cryptocurrencies, particularly Bitcoin and Ethereum, often benefit from these cycles as investors seek alternative stores of value and speculative opportunities.

While Bitcoin has already experienced a strong price recovery in response to this liquidity wave, Ethereum has so far lagged behind. Analysts believe this delayed reaction could set the stage for a powerful catch-up rally, especially as Ethereum’s fundamentals strengthen and supply dynamics tighten.

Source: CryptoQuant

Shrinking Exchange Balances Signal Accumulation

A key on-chain trend supporting a bullish case for Ethereum is the decline in ETH held on centralized exchanges. Since early 2022, the amount of Ethereum available on trading platforms has dropped by more than 25%.

This reduction is significant because lower exchange reserves usually indicate that investors are moving their assets into long-term storage—either to cold wallets for safekeeping or into staking contracts for passive income. In both cases, the immediate liquidity of Ethereum in the market decreases, reducing the available supply for traders and speculators.

When a shrinking supply meets increasing demand, prices often rise sharply. Analysts at XWIN Finance argue that this ongoing accumulation trend is a precursor to a new market phase, where reduced selling pressure could amplify Ethereum’s upside potential.

Macroeconomic Shifts Could Accelerate the Rally

Beyond crypto-specific factors, broader macroeconomic trends may play a decisive role in Ethereum’s next valuation phase. Arthur Hayes, the outspoken co-founder of BitMEX, has highlighted how global political and economic shifts—especially in the United States—could flood markets with even more liquidity.

He predicts that under the Trump administration, the U.S. may enter a “wartime economy” scenario, marked by increased government borrowing, expansive credit policies, and heavy spending on infrastructure and defense. Historically, such periods have driven asset price inflation, as newly created money flows into equities, commodities, and alternative assets like cryptocurrencies.

If this scenario unfolds, Ethereum could benefit disproportionately, given its growing role as both a financial infrastructure layer and a speculative investment vehicle. Increased liquidity could magnify buying interest, pushing ETH prices to new all-time highs.

Institutional Adoption Strengthens Bullish Outlook

The institutional landscape for Ethereum has evolved significantly over the last two years. Major financial institutions, asset managers, and corporate entities are no longer ignoring Ethereum—they are actively integrating it into their products and strategies.

From Ethereum ETFs and structured investment vehicles to staking services for institutional clients, traditional finance is increasingly embracing Ethereum as a legitimate asset class. This influx of institutional capital brings not only liquidity but also long-term stability, as large investors typically hold assets for extended periods.

Kevin Rusher, founder of RAAC, emphasizes that Ethereum’s staking yield is particularly attractive for institutions seeking consistent returns in a low-interest environment. As more entities stake their ETH, the liquid supply continues to tighten, reinforcing the bullish narrative.

Technical Analysis Points to Critical Levels

From a charting perspective, Ethereum is currently hovering near a key resistance zone around $4,800. This level has historically acted as a major barrier, and traders are watching closely to see if ETH can finally break above it.

If Ethereum manages to close above this resistance on the weekly timeframe, analysts believe it could pave the way for a rally toward $7,000 to $10,000, supported by Fibonacci extension targets. However, a failure to break through could trigger a temporary pullback toward the $3,500–$3,800 support region, which would likely serve as a new base for future upward moves.

Source: TradingView

Source: Cryptonews Edited by Sonarx