Bitcoin’s price fluctuates around $115,000 as gold reaches new record highs, but markets are becoming cautious ahead of Wednesday’s FOMC meeting. At Tuesday’s Wall Street open, Bitcoin showed volatility as analysts noted the possibility of liquidations.

BTC/USD one-minute chart. Source: Cointelegraph/TradingView

Bitcoin leverage surges, putting longs at risk

Data from Cointelegraph Markets Pro and TradingView indicated that BTC/USD became volatile as the US trading session commenced. The price fluctuated between $114,800 and $115,300, surrounded by significant liquidity blocks on exchange order books.

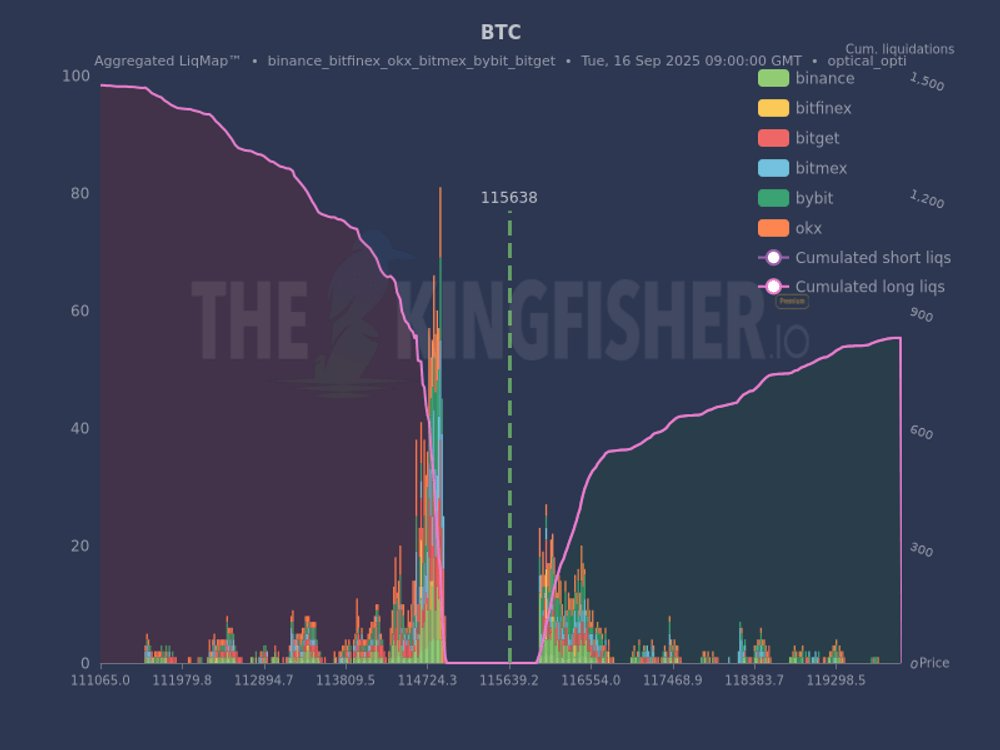

‘There’s a substantial cluster of long liquidations below the current price, particularly around the 114,724.3 level. That represents a lot of trapped longs,’ noted trading resource TheKingfisher in its latest commentary on X.”

BTC order-book liquidation levels. Source: TheKingfisher/X

A chart accompanying the analysis illustrated critical ‘pain’ levels for traders above and below the spot price. ‘This chart doesn’t predict the future, but it highlights where the pain points are. Price movements often follow these pain levels,’ TheKingfisher noted, emphasizing the high leverage present in the market.

The day before, well-known trader Skew pointed out similar low-timeframe volatility, suggesting potential manipulative behavior. ‘The market remains top-heavy with ongoing supply and offloading into price,’ he summarized in his latest market update. Skew mentioned that traders were increasingly going short ahead of this week’s key macroeconomic event: the US Federal Reserve’s interest rate decision, with the Federal Open Market Committee (FOMC) expected to cut rates for the first time in 2025 by 0.25%.

‘There’s already considerable positioning decay leading into the FOMC, which isn’t surprising, although short positioning is beginning to rise as it becomes the consensus trade,’ he concluded.

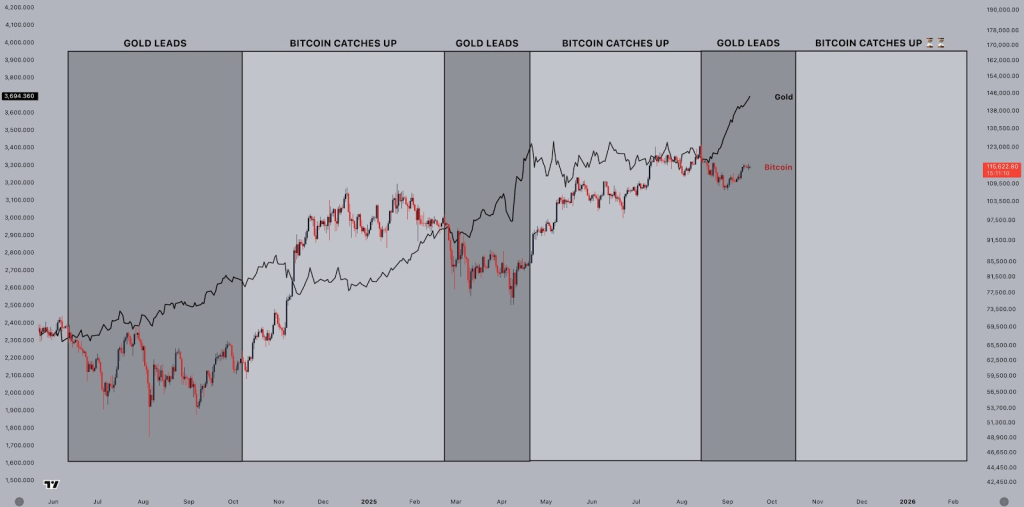

BTC price action has yet to mirror gold’s movements.

Pre-FOMC jitters were evident across risk assets, with US stocks slightly down at the open, while gold experienced significant volatility and reached a new all-time high of $3,703.

As reported by Cointelegraph, analysis suggests that both Bitcoin and gold are ‘pricing in’ future US economic conditions. ‘Gold leads the way; Bitcoin follows,’ noted popular trader Jelle in an X reaction, highlighting Bitcoin’s tendency to lag behind gold’s price movements by several months. Year-to-date, gold has significantly outperformed Bitcoin, rising 40% since the beginning of the year compared to Bitcoin’s 23% increase.

BTC/USD vs. XAU/USD chart. Source: Jelle/X

Source: Cointelegraph Edited By Bernie