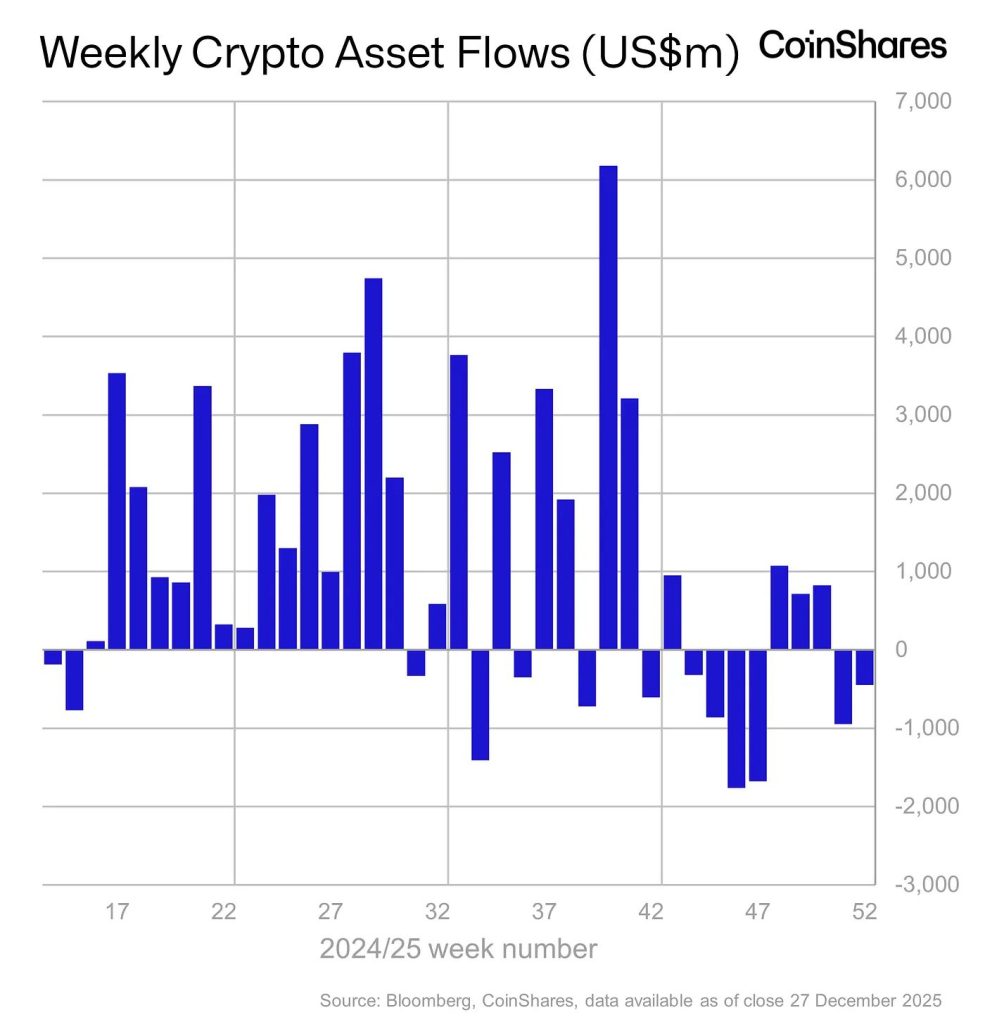

Crypto Investment Funds Record $446 Million in Weekly Outflows Despite XRP Strength

Crypto-focused investment products experienced significant capital withdrawals over the past week, with total outflows reaching approximately $446 million. This occurred even as XRP posted notable price gains, highlighting a continued divergence between broader market sentiment and isolated asset performance.

Market data indicates that investor caution remains high, largely driven by ongoing uncertainty around global monetary policy and expectations that interest rates may stay elevated for longer than previously anticipated. These macroeconomic pressures have contributed to reduced risk appetite across digital asset markets.

Bitcoin-linked investment products accounted for the majority of the outflows, reflecting weakened confidence among institutional investors. Ethereum-based funds also saw moderate withdrawals, suggesting that the selling pressure was not limited to a single asset category. In contrast, XRP-related products attracted modest inflows, benefiting from renewed optimism tied to recent developments surrounding the asset.

Source: CoinShares

Geographically, the largest outflows were recorded in the United States, while certain European markets showed relatively stable or slightly positive activity. This regional disparity points to differing investor responses to market conditions and regulatory expectations.

Overall, the latest figures suggest that while select cryptocurrencies may experience short-term momentum, broader institutional sentiment toward digital assets remains cautious. Analysts note that sustained inflows are unlikely to return until there is greater clarity around economic policy and long-term market stability.

Source: Cryptonews Edited by Sonarx