Bitcoin may be on the verge of a substantial price movement, as investment volumes indicate a bullish trend that has been in place since late 2023, according to recent research.

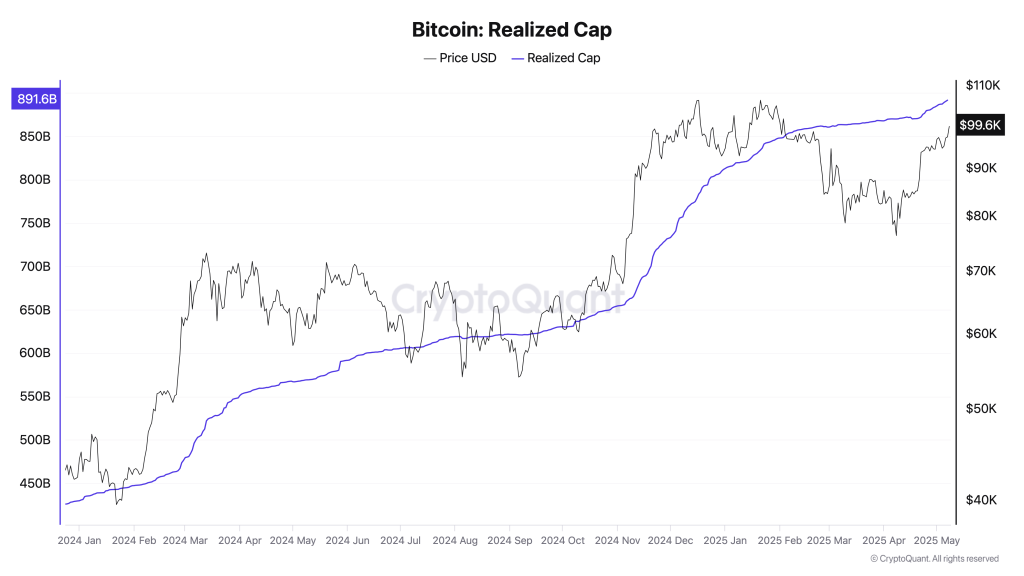

The cryptocurrency is reaching new all-time highs in network value as it aims for a six-figure price. Data from the on-chain analytics platform CryptoQuant shows record highs for Bitcoin’s realized market cap.

Bitcoin Realized Cap Indicates Growing Confidence

Bitcoin’s value in USD is at an all-time high when considering its market cap based on the price at which the current supply last moved on-chain. This “realized cap” has consistently reached new heights since mid-April, reflecting a sustained recovery in BTC/USD, with a figure of $891 billion reported as of May 7.

“Recent weeks have seen a steady influx of capital into Bitcoin, signaling renewed interest from investors,” noted CryptoQuant contributor Carmelo Alemán in a May 7 “Quicktake” blog post.

Alemán suggested that the upward trend in realized cap signifies a long-term shift in the Bitcoin market among investors.

“This new peak in Realized Cap not only highlights an increase in invested capital but also demonstrates a growing belief in Bitcoin’s potential as a financial asset,” the post concluded. “With ongoing accumulation from both long-term and short-term holders, the market seems poised for a significant price breakout. If this trend continues, we may be witnessing the early stages of a new bull cycle for Bitcoin.”

Bitcoin realized cap. Source: CryptoQuant

BTC Capital Influx Continues Since 2023

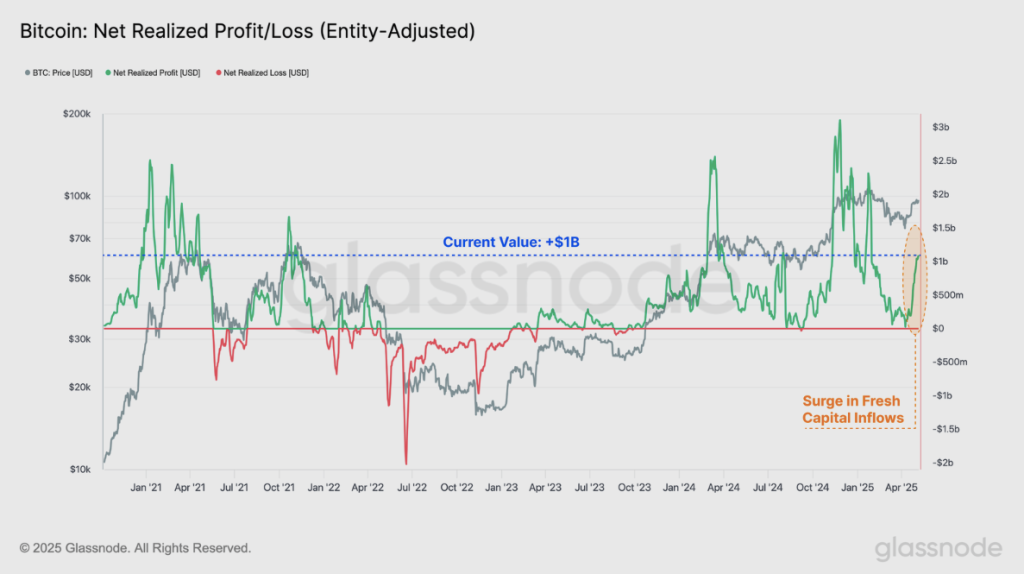

As reported by Cointelegraph, there are ongoing concerns regarding the sustainability of the current market rebound.

Particularly, there are worries about profit-taking, leading to suspicions that higher prices may not hold. Both long-term holders (LTH) and short-term holders (STH) have taken this opportunity to secure profits, averaging around $1 billion daily.

In its latest newsletter, “The Week Onchain,” research firm Glassnode contends that buy and sell-side conditions are currently balanced at approximately $100,000.

“Recent weeks have seen a noticeable increase in profit-taking, with the latest rally attracting over $1 billion per day in net capital inflows,” it wrote.

“This points to initial indicators of a return of demand-side strength, allowing sellers to lock in profits, and speaking to buyers willing to pick up coins at the current market price. Generally speaking, this points to a wave of demand which is absorbing the incoming supply.”

Bitcoin net realized profit/loss (screenshot). Source: Glassnode

Glassnode added that the quest for profits has, in fact, extended for over 18 months.

“Notably, the market has sustained a profit-driven regime since October 2023, with capital inflows consistently exceeding outflows. This steady influx of fresh capital serves as an overall constructive signal,” it stated.

Source: Cointelegraph Edited By : Bernie

#MarketNews #BitcoinPrice #bitcoin #cryptos #crypto #cryptocurrency